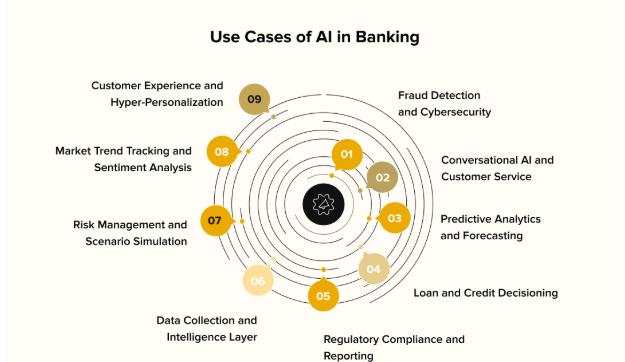

Artificial Intelligence (AI) is no longer a futuristic concept in finance; rather, it is the powerhouse running the modern banking sector. From fraud detection to personalised investment strategies, AI has emerged as one of the most crucial tools for financial institutions looking to operate at high speed, with accuracy, and with customer-centric innovation. The majority of leading banks today, such as Bank of America, DBS, Wells Fargo, JPMorgan Chase, HSBC, and others, are leveraging AI to optimise every element of their value chains.

In this blog, we will explore the most frequently used AI systems and Tools by banks today, how they work, and why they are making them indispensable for future-ready banking and financial services.

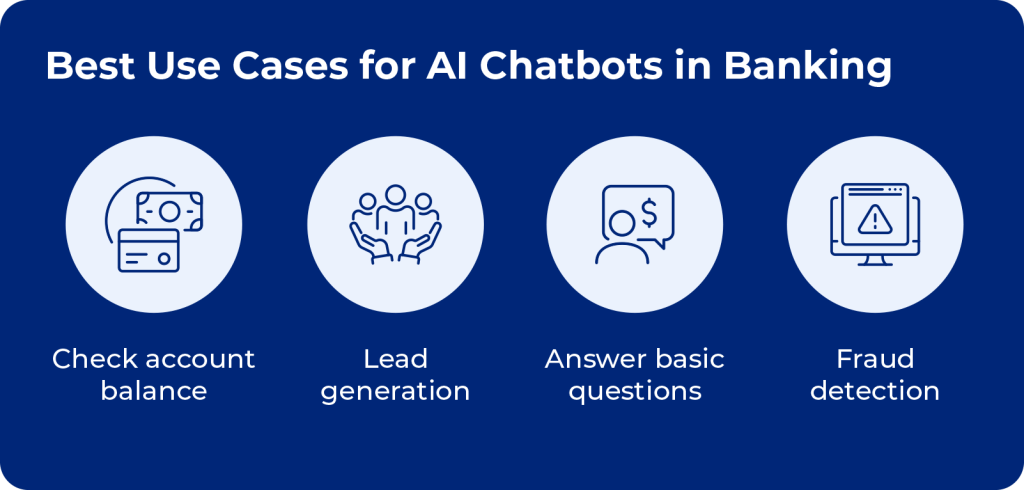

1. AI-Powered Chatbots & Virtual Assistants

One of the most significant revolutions in modern banking is the development of AI chatbots that provide instant, human-like support. These virtual assistants can resolve 80% of the queries of the customers\ without the requirement of human presence and also help in improving the experience of the users.

Leading Tools

- Erica by Bank of America: The tool handles millions of customer interactions, ranging from balance checks to financial insights.

- KAI by Kasisto: The tool is used by DBS, Mastercard, and ABSA for complex and advanced banking conversations.

- Google Dialogflow & IBM Watson Assistant: The tool is used by multiple banks and financial institutions for 24/7, multilingual customer service.

Reasons for being used by leaders

- Reduces the workload of customer service.

- Quick issue resolution

- Customised responses based on transaction history

- Reduced operational cost

2. Fraud Detection and Risk management AI tools

Fraud is becoming increasingly sophisticated, and AI-based detection systems are advancing. Banks today use machine learning (ML) algorithms to scan millions of financial transactions per second and highlight any unusual patterns much earlier than human eyes.

Leading Tools

- Feedzai: The tool is used by banks such as Lloyds and Citi for advanced fraud detection.

- Darktrace AI: The tool enables real-time threat detection for insider risks and cybersecurity.

- FICO Falcon: It is an industry-standard fraud detection and analytics tool used by more than 9,000 banks worldwide.

Why are these tools effective?

The AI models can

- Detect any time anomalies instantly in real-time

- Predict the fraudulent patterns even if they occur

- Reduces the number of false positives

- Improves the audit and compliance checks.

Fraud can cost banks and financial institutions billions of dollars annually; therefore, AI tools protect customers and the banks’ reputations.

3. Algorithmic Trading and Investment Intelligence

AI is more than automated trading and is reshaping the entire investment landscape. Institutional investors and Hedge funds now use AI to predict price movements, analyse markets, and execute trades at very high speed.

Leading Tools

- Numerai Signals & Tournament Models: Crowdsourced AI predictions for equities.

- Kavout (Kai Score): A-based ranking of stocks with the help of deep learning.

- Alpaca & QuantConnect: Helps with algorithmic trading through AI-based strategy integration.

Reasons for being used by the investors

- Helps in faster market analysis

- Practical and emotion-free decision making

- Capability to handle and process large datasets

- Predicting the trading signals

AI also helps identify hidden correlations that human analysts might miss, making it a powerful tool for both institutional and retail investors.

4. Credit Scoring and Loan Decision System

Traditional credit scoring includes only a few selected data points. However, AI-based credit assessment considers hundreds of variables, providing a more accurate and inclusive evaluation.

Leading tool

- Zest AI: The tool is mainly used by credit unions to approve loan borrowers more accurately and fairly.

- Upstart: an AI-backed lending platform that helps in reducing default rates and also expands credit access.

- Experian PowerCurve: Makes use of Big Data AI for making advanced decisions.

Reasons Banks are making use of AI scoring

- Help in undertaking more detailed and accurate borrower profiling

- Reduces the credit risk

- Quicker loan approvals

- Help in evaluating new-to-credit customers

AI tools play a significant role in reducing financial losses and improving lending opportunities for the underserved segments.

5. AI in regulatory monitoring and compliance

Compliance is one of the most significant cost centres in banking. AI tools help automate compliance tasks that previously required weeks. AI tools help analyse suspicious activities and verify KYC documents.

Top Tools used Today

- Ayasdi AML: Makes use of ML for uncovering the hidden risk in the anti-money laundering processes.

- ComplyAdvantage: AI-powered AML and sanction screening.

- Trunomi: Automates compliance with global data protection regulations.

Benefits

- Faster AML/KYC checks

- Reduced regulatory penalties

- Simplifies the documentation process

- Automatic identification of suspicious activities

The bank faces significant financial and reputational losses from compliance failures. Therefore, AI helps in reducing costly mistakes.

6. Customer insights and personalised banking

Today’s modern customer requires personalised financial recommendations, and AI plays a significant role in enabling this. The AI tools use behavioural patterns and customer data to deliver hyper-personalised advice.

Leading Tools and Solutions

- Salesforce Einstein for Financial Services: Lead scoring, automates the recommendation, and customer journey.

- Personetics: The tool is used by Santander, UOB, and Metro Bank for real-time customer insights.

- AWS AI/ML Models: Provides personalised service for fintechs and neo-banks globally.

What does it enable?

- Personalised product recommendation

- Personalised spending and saving insights

- Proactive nudges and alerts

- High customer engagement and loyalty

AI-powered personalisation helps improve customer satisfaction while increasing revenue per user.

7. Robotic Process Automation (RPA) in banking operations

Back-office operations are considered the backbone of banking and financial institutions. AI-powered tools play a significant role in transforming back-office operations. RPA automates repetitive tasks such as reconciliation, data entry, and document verification with near-perfect accuracy.

Top RPA Tools used

- UiPath: Automates the customer onboarding, KYC and reconciliation tasks.

- Automation Anywhere: manages high volumes of back-office functions.

- Blue Prism: Provides enterprise-level, secure banking automation.

Value Delivered

- Lower processing costs

- Almost zero human error

- Quicker operations

- Streamlined workflows

Various banks, such as Barclays and Deutsche Bank, have automated thousands of processes with RPA tools.

The future of AI in finance: What’s coming next?

Now we are entering a new era of banking in which customers require faster, personalised, and almost frictionless banking. Future trends in the finance sector include:

- AI-powered robo-advisors are replacing traditional human wealth managers for mass-market customers.

- Blockchain + AI for more transparent and secure digital transactions.

- Predictive banking, in which the banks suggest future actions before the customers demand them.

- Generative AI in financial planning, providing tailored simulations and forecasts.

The banks that incorporate AI today will become leaders of tomorrow.

Final Thoughts

AI is no longer an option in the financial industry; it provides a competitive advantage, pushing the industry forward. From hyper-personalised banking to fraud detection, AI tools are assisting financial institutions to operate faster, smarter, and more securely. Banks that adopt AI not only help reduce operational costs but also improve risk management, deliver a better customer experience, and generate richer insights. As the financial ecosystem becomes more digital, AI will influence how money moves and how banks operate.