The report highlights that dividend policies are influenced by a firm's ability to make payments, earn profits, and maintain its retained earnings. The main purpose of this report is to demonstrate the evaluation of the dividend policy of an organisation and how it affects the shareholder's values. However, the M&M model of divided indicates that there is no relationship between divided policies and the wealth of the investors. The literature section suggests that two types of theories are relevant in the context of explaining dividend policies. The (British American Tobacco) BAT's performance in the last couple of years indicates that BAT is paying off dividends on a quarterly basis, indicating a strong future for its shareholders. The findings of this report indicate that BAT has been able to increase the value of the shares by making adequate strategies which include accumulation of retained earnings and decreasing debts of the organisation.

1. Introduction

Examination of dividend policies of an organisation is essential to determine the profitability of investing in the businesses. It can be said that making a complete analysis of the dividend history of an organisation can help an investor decide whether they should invest in the company or not as it refers to the income provided by the company to the investors who have invested money as capital into the business. Therefore, making an evaluation of dividend policy is essential as it demonstrates the management's confidence in terms of business prospects and helps develop trust among the stakeholders, boosting their investment confidence. In order to incorporate this aspect, a well-recognised tobacco manufacturing organisation, British American Tobacco, has been chosen. The main purpose of developing this report is to demonstrate the efficiency of the investment decisions made by the investors for investing in BAT. In this context, to analyse the dividend policy of British American Tobacco (BAT), the company's official website has been used from where the detailed dividend history of the company has been gathered. Three important ratios have been chosen by the analysts that will be implied in this aspect. The dividend policy of BAT has been chosen to analyse because the company's performance improved despite lockdowns and Covid-19 in the year 2020. Also, the company has provided higher dividends, thereby increasing shareholders wealth. Therefore, it is justified to incorporate the company's dividend policy and how it has remained profitable for the investors.

2. Literature based on the theoretical framework of dividend policy

2.1 Definition of Dividend policy and theories

According to Baker et al. (2019), the dividend policy theory refers to the strategy or policy of a company used to distribute a certain portion of the income as a dividend among the shareholders or investors. More specifically, it has also been identified that dividend policy is known as a part of an organisation's strategy to attract investors in making investments. Three types of dividend can be identified; Residual, Constant and Stable.

Olarinde et al. (2019) research show that the company is not obliged to make dividend payments to repay the investment. The researcher also identified that investors of a company could sell their shares to accumulate funds. On that note, the dividend becomes irrelevant, and dividend irrelevance theory can be considered useful. It has been identified by Olarinde et al. (2019), through conducting primary research on the Nigerian firms, that the dividend payout ratio has no impact on the M-M hypothesis, which is based upon the dividend irrelevance theory. The author has also described the dividend preference theory, which depicts that the dividends received in the present time are preferable to dividends that can be received in future. The theory also explains that the dividends are subjected to uncertainty. A positive link between the market value of the shares and dividend payment is observable, which helps in attracting more investors to a company.

2.2 Irrelevance of dividend policies

The research of Mardiana & Setiyowati (2019) has explained the irrelevance of the dividend aspect thoroughly. The author observed that the dividend irrelevance communicated as an M-M hypothesis as well. The irrelevance of the dividend depicts that it is assumed that in the practical or real-world, the shares' market price significantly impacts the dividends' quoted price (Mardiana & Setiyowati, 2019). Therefore, a relationship between these two factors are observable; however, the theory has identified that the dividend prices or the changes in the dividend will not impact the wealth of the shareholders or investors because the value of the market share and value of an organisation is completely dependent upon the investment policies and earnings generated by the firm in a year (Banerjee, 2018). Therefore, the dividend has been identified as completely irrelevant to the concept of creating or increasing the value of the shares and wealth of the investors. The theory has identified that the organisations usually invest in creating excess funds, which helps indicate a positive NPV (Net Present Value).

2.3 Applicable models

This section discusses the two dividend models in the following:

(a) Gordon’s Model

As Belomyttseva et al. (2018) explained, Gordon's dividend model can be referred to as the dividend preference model. As per the evaluation, it has been identified that dividend policy significantly impacts a company’s market price. Such a conclusion has been reached by considering eight different assumptions made by Gordon while developing his theory. The first assumption depicts that organisations must have to be equity-based, while the second assumption states there is no scope for accumulating funds from the external sources of the business. The third assumption depicts that IRR is constant, and the available retained earnings of the organisation are required to be used. The fourth and fifth assumption depicts that the discounting factor will be constant and earnings of the organisation are required to be perpetual (Duncan et al. 2017). The last three assumptions depict that there are no tax rates applicable, the retention ratio would be constant, and Kbr needs to be equal with g, where g refers to the growth. The Gordon model of dividend refers that the intrinsic value of shares is estimated by adapting to this approach while a certain growth percentage is also considered to implement.

(b) M&M model

Kumaraswamy et al. (2019) explained that the M&M or Modigliani-Miller theory refers to the fact that shareholders of a business do not pay attention to the dividends paid off by an organisation. Therefore, to calculate the valuation of an organisation, the value of the dividend is excluded from this aspect. Therefore, it can be depicted that the M&M model is a notion of the dividend irrelevance concept. Moreover, the author has identified that this model has described that only the earnings of the company generated in a particular period of time can impact the valuation of the shares.

2.4 The signalling factors of dividend policies

The signalling properties of a dividend are about the company’s declaration that dividends will be paid off to its investors in the future. Therefore, it is considered a prediction that denotes the relevance of profitability that indicates a positive future for a company (Huotari, 2020). The signalling properties are related to the game theory and consist of several factors such as retained earnings, cash inflows of the organisation and total earnings of the company in a year. More specifically, it has been identified that the organisations making high-level dividend payments signal their high profitability. On the other hand, another signalling property of dividend payment is referred to as cash inflows. It has been determined that learning can be increased when the cash inflows increase and overall dividend payment is positively influenced (Al-Shattarat et al. 2018).

2.5 Impact of different identified factors on dividend policy

(a) Investment opportunities

The investment opportunities are created when the level of income from the organisation's increases. It has also been identified that such an opportunity impacts the dividend payout ratio of an organisation. The research of Jaara et al. (2018) shows that increasing the dividend opportunity reduces the payment of dividends. However, when such a strategy becomes successful in later periods, an increase in dividends will be observable.

(b) Investment policy

According to Budagaga (2017), dividend policies developed by the organisations are also considered the factor that can impact the investment. The level of dividend being paid or proposed by the organisation to be paid to its shareholders helps in influencing the investment decision of the organisation’s investment policy. With a better investment policy, the organisation will increase the value of the shares and on which better dividends can be provided later.

(c) Clientele effects

According to Mo & Subrahmanyam (2019), the idea of clientele effect refers to positive and changes that occur in the context of the dividend policies of organisations and as a result of the changes, it has been identified that clientele will sell their investments. Therefore the stocks based on which the dividends are being paid are decreased. The clientele effect also depicts that some investors prefer that dividend by the company is not paid off. Rather, it is invested in the retained earnings because the valuation of the share prices increases and the stocks can be sold at a higher price (Mo & Subrahmanyam, 2019).

3. British American Tobacco’s Dividend Policy

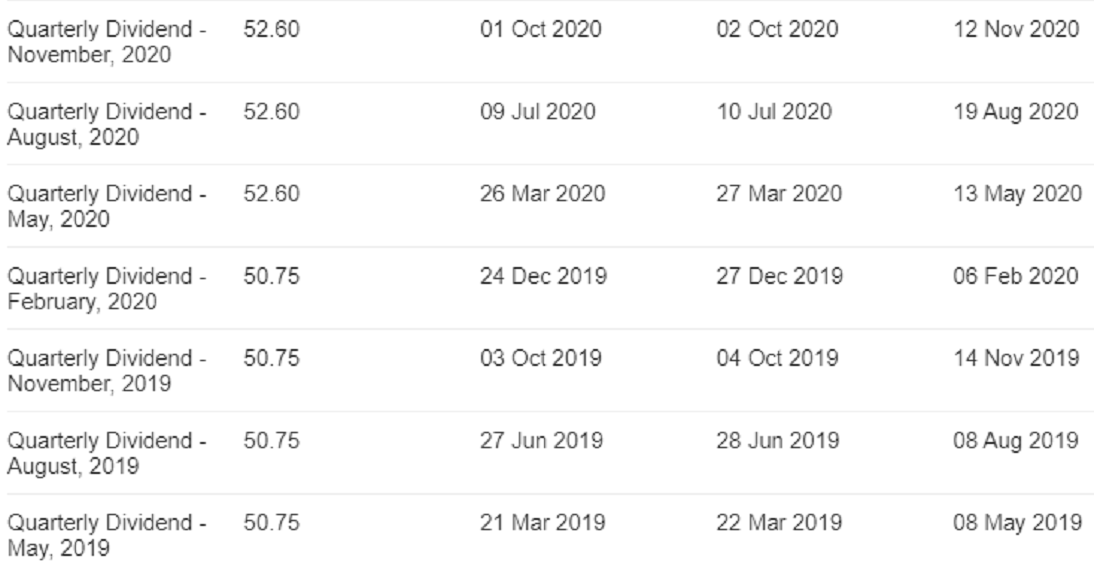

The organisation's dividends payment history has been evaluated in the following section to analyse British American Tobacco's dividend policy.

(Source: bat.com, 2021)

Making a complete analysis of the above figure (figure no. 1) helps in considering that the chosen organisation has been continuously providing dividends over the last few years. More specifically, the organisation's dividend policy depicts that it pays off the dividend quarterly to its shareholders. The figure indicates that the organisation's profitability has increased as the dividend has increased from 48.80 GBP per share in each quarter in February 2019 to 52.60 GBP per share in each quarter in November 2020 (bat.com, 2021).

Conducting ratio analysis can also be considered important in terms of explaining the dividend policy of a company.

| Particulars | 2019 | 2020 | Formula |

| Dividend payout ratio | 0.842611 | 0.77 | Dividend Per Share /Earnings Per Share |

| Net debt to earnings ratio | 4.70 | 4.12 | (Total debt - cash and cash equivalent)/ EBITDA or operating income |

| Dividend yield ratio | 0.077897 | 0.078859 | Dividend per share/ market value of each share |

Table 1: Calculation of three important ratios of BAT (Source: created by the learner)

3.1 Dividend payout ratio

It has been identified that the payout ratio decreases despite the increase in the amount of dividend payment. The dividend payout ratio helps in identifying the amount paid off by a company out of the total income generated by the organisation (Herawati & Fauzia, 2018). In the context of BAT, it is observed that the payout ratio has decreased from 0.84 to 0.77, which depicts that the proportion of dividends paid in 2019 has decreased. Therefore, it can be depicted that the organisation has become less profitable and may be facing challenges in paying off the dividends (Rivandi & Ariska, 2019). The ratio depicts that BAT has increased the retained earnings by decreasing the dividend payout ratio as the retained earnings have increased from 40234000 thousand GBP in 2019 to 42041000 thousand GBP in 2020 (finance.yahoo.com, 2021).

3.2 Net debt to earnings ratio

The debt to earnings ratio can also be considered essential to determine the profitability, financial health of the dividend policy of the company. It is estimated by dividing the net debt of the organisation by the earnings before tax, interest, depreciation and amortisation expenses for a specific period of a company (Priliyastuti & Stella, 2017). Based on that evaluation, it is observed that the organisation's debt to earnings has decreased from 4.70 to 4.12, reflecting enhancement of being able to manage the debt by using earnings for the period. This indicates that BAT's ability to meet the expenses has significantly changed positively, indicating a leveraged position for the company. It is because the decrease in this ratio means that the organisation can meet the debts very efficiently. If it increases, the company is not able to meet the expenses. In the context of BAT, it is observed that the company's ability to meet the debt in 2020 has decreased, affecting the investment decision of the organisation. The impact of Covid-19 on the company can also be considered insignificant in this aspect because, despite Covid-19, the liabilities had decreased from 45366000 thousand GBP in 2019 to 43968000 thousand GBP in 2020. The total amount of available cash has increased from 2008000 thousand GBP in 2019 to 2048000 thousand GBP in 2020. The EBITDA has been increased from 9230000 thousand in 2019 to 10176000 thousand in 2020 (finance.yahoo.com, 2021).

3.3 Dividend yield ratio

According to Marito & DewiSjarif (2020), the dividend yield ratio helps in identifying the percentage of a portion of the company's share that is being paid off as a dividend to a shareholder or investor. This measure is calculated by dividing the market value of shares by the DPS. An increase from 0.77 to 0.78 times helps in estimating that BAT has increased its dividend percentage on the market value of each share. This indicates BAT has been able to generate a higher amount of income in the year 2020 (6400000 thousand GBP) compared to 2019 (5704000 thousand GBP) (finance.yahoo.com, 2021).

4. Impact of the dividend policy of BAT on shareholder’s value

The dividend payment history indicates that the earnings for investors of the organisation have increased because of the increased amount of dividend (210.4 pence in 2019 and 215.6 pence in 2020) and market value of shares (2701 GBX in 2019 and 2734 GBX in 2020). Besides, as it has been observed that the dividend payment has increased, which refers to the fact that the company has increased the investment in the retained earnings, which can significantly increase the price of the shares. Hence the investors' wealth is positively affected. Another justification for an increased wealth of BAT investors and increased share value would be increased retained earnings in the last two years. Therefore, it has impacted the market value of the shares (Balqis, 2021). However, by increasing the number of dividends, the organisation has been attracting investors. Therefore, it can be considered as a useful approach for the company. It is clearly observable that the dividend yield ratio has improved, indicating a positive impact on the investor's valuation. The organisation has paid more percentage out of the shares price in the year 2020 than 2019. Therefore, the investors are able to get a higher amount in the year 2020 than the previous year 2019.

5. Conclusions

Making a complete evaluation of the above scenario helps identify the fact that there are two types of approaches in dividend policy. It is observed that BAT has adapted to a quarter-based payment divided policy for their investors. This can be justified by looking at the dividend payment history of the organisation from their official website. While dividend preference theory supports that the dividend policy significantly influences the shareholders' wealth, the M&M model of Dividend irrelevance theory opposes this explanation. It is because the valuation increases when more accumulation is done in the retained earnings. Furthermore, the above evaluation helps in concluding the fact that an organisation’s future cash flows, profitability and total earnings are the indicators of a positive future. Besides, it is also found that certain factors such as investment opportunities and policies and clientele effects have a significant impact on a company's dividend policy. It is because these attract investors and help in providing more income to investors as a form of the dividend. In the context of BAT, it is observable that despite the decrease in overall performance in 2020, the company maintained its dividend payments quarterly, which indicates a strong future for the company and the investors. It has also been observed that the amount of dividend has increased for the shareholders of BAT despite a decrease in the ability to meet profitability. The ratio analysis depicts that BAT has been paying a lesser portion of the earnings per share compared to previous years as dividends to its investors. However, the total amount of dividends and the total proportion of dividends out of the market value of each share and the retained earnings that affect the share valuation have increased. So, the overall value proposition to shareholders by BAT is positive in prospect. It can be depicted that the company can increase its performance and value of the shares by earning more income in the next years. Increasing the contribution of earnings or profit to the retained earnings can also be considered helpful for BAT to make an efficient dividend policy for its investors and increase the market valuation of the shares held by investors.